The year is 2024, and the business landscape is more competitive than ever. Companies are navigating volatile markets, global disruptions, and ever-tightening profit margins. In this scenario, optimizing your supply chain is a survival tactic. At the heart of this streamlined flow lies a hidden weapon: supply chain finance software.

SCF software is a bridge between traditional trade finance and working capital management. It empowers you to pay your suppliers earlier and free up trapped cash within your organization. With faster payments, your suppliers can invest in growth, build inventory, and become more reliable partners.

But with an array of supply chain software solutions available, choosing the right one can feel overwhelming. Fear not! This blog post will guide you through the strengths and weaknesses of some of the top SCF software solutions in 2024.

Importance of Supply Chain Finance Software:

SCF software goes beyond simply offering early payments. It acts as a catalyst for a complete transformation of your supply chain. It impacts almost every aspect of your business operations. Here’s how:

- Break free from the traditional “pay later” cycle and inject liquidity into your organization. Use the freed-up capital for strategic investments, research, and development.

- Facilitate your suppliers with faster, more predictable payments. This not only strengthens relationships but also secures better deals. Happy suppliers translate to a happier, more resilient supply chain.

- Supply chain finance software automates manual tasks. It eliminates paperwork and smoothens communication across the entire supply chain.

- It provides real-time visibility into supply chain data. This helps to optimize inventory management and proactively address potential challenges.

- SCF software promotes transparency and collaboration. It allows you to anticipate and mitigate risks throughout your supply chain. This builds a more resilient organization, capable of weathering unexpected disruptions.

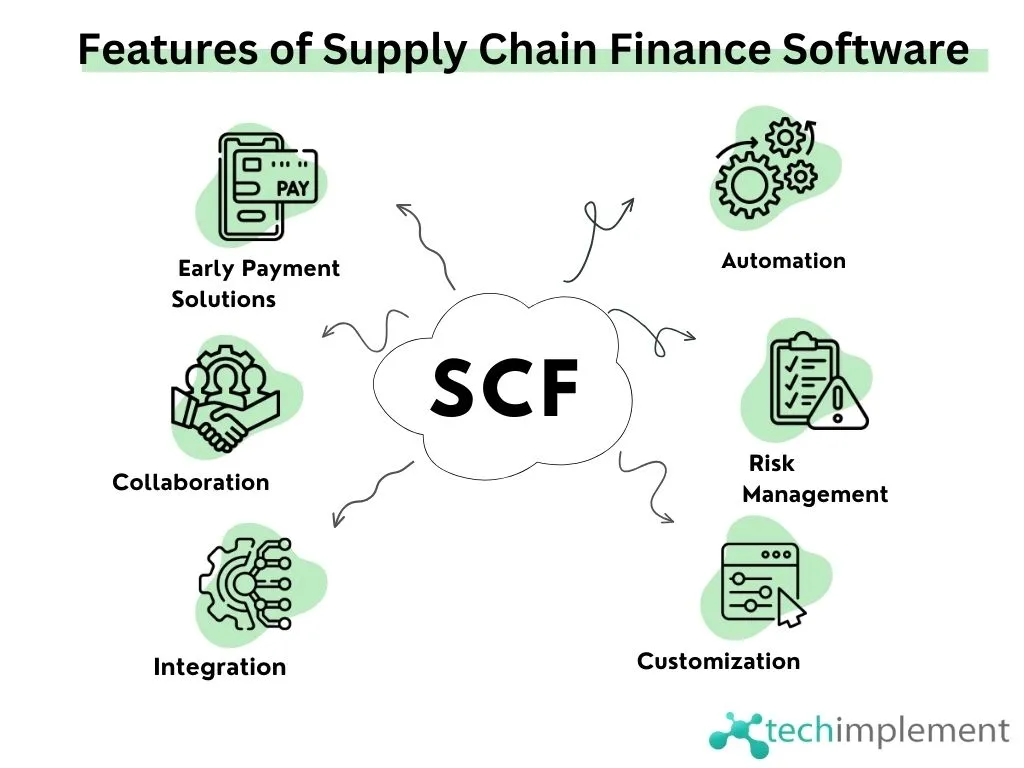

Key Features of Supply Chain Finance Software

SCF software boasts diverse features that help you optimize your supply chain. Here are some key features to consider:

1. Early Payment Solutions:

- Offer suppliers varying discounts based on invoice payment speed.

- Pay suppliers early directly, often at a discounted rate.

- Partner with financial institutions to provide early payment options.

2. Automation :

- Automate invoice capture, approval, and payment workflows.

- Securely store and manage invoices, contracts, and other supply chain documents.

- Monitor the status of all payments in real time.

3. Collaboration and Visibility:

- Enable secure communication and information sharing with suppliers.

- Gain real-time visibility into inventory levels, purchase orders, and payment terms.

- Generate comprehensive reports to analyze supply chain performance and identify areas for improvement.

4. Risk Management and Compliance:

- Assess the financial health of potential suppliers.

- Implement mechanisms to identify and prevent fraudulent activity.

- Ensure adherence to relevant trade finance regulations.

5. Integration and Customization:

- Integrate with your existing ERP system.

- Connect with other platforms and applications to extend functionality.

- Adapt the software to meet your specific business needs and processes.

Top Supply Chain Finance Software of 2024

Here is the list of top SCF software that you need to check out in 2024:

1. SAP Ariba:

SAP Ariba stands out for its end-to-end procurement and supply chain management capabilities. It integrates with other SAP solutions, offering a holistic approach to business operations. It has unique features such as supplier collaboration, strategic sourcing, and robust analytics. SAP Ariba helps organizations to optimize their supply chain processes. The platform enhances visibility, reduces costs, and facilitates efficient collaboration with suppliers.

[i2pc pros_icon=”icon icon-thumbs-o-up” cons_icon=”icon icon-thumbs-o-down” show_title=”false” title=”Pros & Cons” show_button=”false” pros_title=”Pros” cons_title=”Cons” heading_pros_icon=”icon icon-thumbs-s-up” heading_cons_icon=”icon icon-thumbs-s-down” ][i2pros]- Seamless integration with SAP ERP systems

– Global reach and extensive supplier network

– Advanced analytics and reporting capabilities[/i2pros][i2cons]- Complex and expensive for smaller businesses

– Limited flexibility and customization options[/i2cons][/i2pc]

2. Basware:

Basware is recognized for its innovative supply chain finance solutions that focus on automating financial processes. The platform facilitates seamless invoice processing, allowing businesses to manage transactions efficiently. It has features like dynamic discounting and early payment options. The platform has a user-friendly interface. This makes it a valuable asset for businesses looking to enhance their financial agility.

[i2pc show_title=”false” title=”Pros & Cons” show_button=”false” pros_title=”Pros” cons_title=”Cons” heading_pros_icon=”icon icon-thumbs-o-up” heading_cons_icon=”icon icon-thumbs-o-down” ][i2pros]Intuitive interface and easy implementationAutomated invoice processing and payment workflows

Strong supplier onboarding and support[/i2pros][i2cons]Limited functionality compared to broader ERP solutions

Pricing based on transaction volume can be costly for high-volume businesses[/i2cons][/i2pc]

3. Tradeshift:

Tradeshift is a cloud-based supply chain finance platform. It provides a digital platform for procurement, invoicing, and payments across the supply chain. Tradeshift’s adaptable nature allows businesses to quickly adapt to changing market dynamics. The platform’s capabilities include e-invoicing, supplier financing, and supply chain collaboration.

[i2pc show_title=”false” title=”Pros & Cons” show_button=”false” pros_title=”Pros” cons_title=”Cons” heading_pros_icon=”icon icon-thumbs-o-up” heading_cons_icon=”icon icon-thumbs-o-down” ][i2pros]Open network connects businesses with a vast pool of suppliers and financiers

Real-time visibility into supply chain transactions

Flexible pricing model based on subscription[/i2pros][i2cons]Limited control over data and security compared to closed-loop solutions

May require additional integration with existing systems[/i2cons][/i2pc]

4. Orbia:

Orbia offers a suite of supply chain solutions designed to enhance visibility and collaboration. Orbia’s platform integrates supply chain finance with broader business processes. It features tools for procurement, logistics, and supplier collaboration. Orbia’s supply chain finance capabilities contribute to optimizing working capital and reducing risks. This makes it a versatile choice for organizations committed to supply chain management.

[i2pc show_title=”false” title=”Pros & Cons” show_button=”false” pros_title=”Pros” cons_title=”Cons” ][i2pros]Fast and easy deployment, ideal for quick wins

Scalable and adaptable to growing business needs

Competitive pricing for mid-market companies[/i2pros][i2cons]Limited functionality compared to enterprise-grade solutions

May not offer advanced features for complex supply chains[/i2cons][/i2pc]

5. eFactor:

eFactor specializes in supply chain finance solutions aimed at optimizing cash flow. The platform offers dynamic discounting, invoice financing, and supply chain analytics to help businesses manage their finances. eFactor’s user-friendly interface makes it accessible for both buyers and suppliers. It provides flexible financing options and automates invoice processes. eFactor helps businesses to strengthen their financial positions and build more responsive supply chains.

[i2pc pros_icon=”icon icon-thumbs-o-up” cons_icon=”icon icon-thumbs-o-down” show_title=”false” title=”Pros & Cons” show_button=”false” pros_title=”Pros” cons_title=”Cons” heading_pros_icon=”icon icon-thumbs-o-up” heading_cons_icon=”icon icon-thumbs-o-down” ][i2pros]Flexible financing options to suit various supplier needs

Competitive discount rates and quick funding

Experienced team with deep expertise in trade finance[/i2pros][i2cons]Focus on financing may overshadow broader SCF functionalities

Limited integration with other supply chain systems[/i2cons][/i2pc]

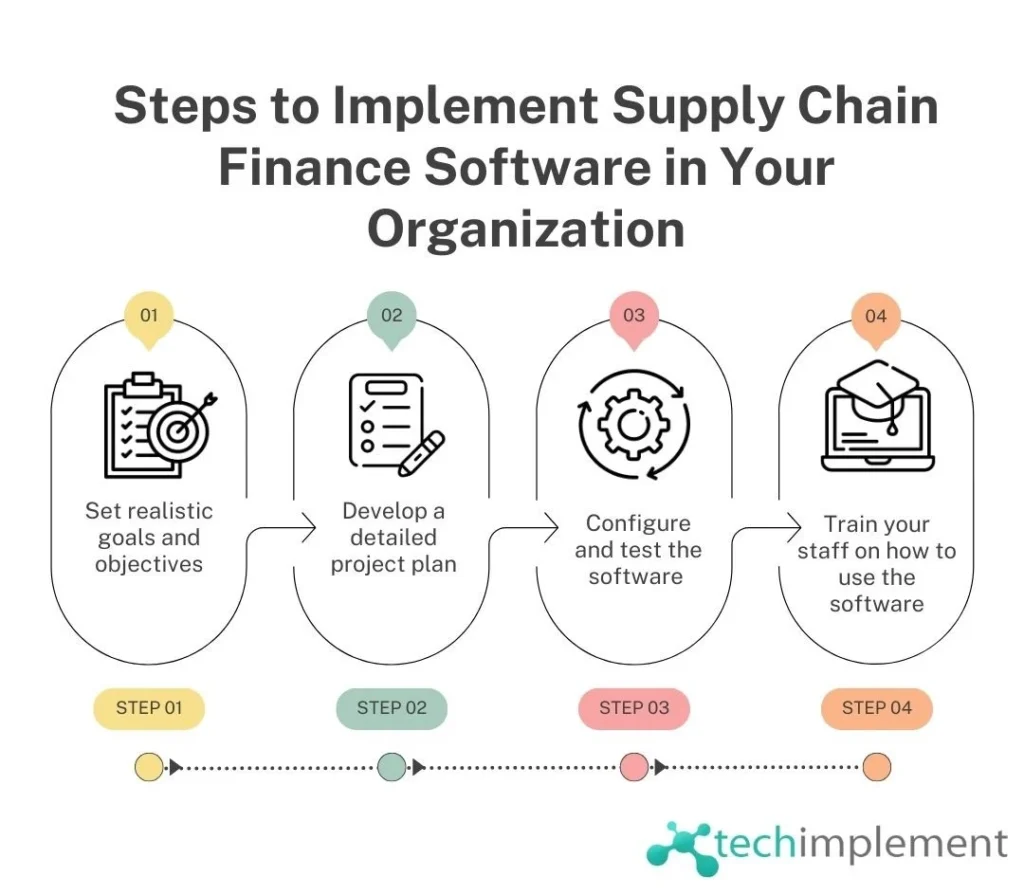

How to Implement Supply Chain Finance Software in Your Organization

Conclusion

In conclusion, choosing the right supply chain finance software can seem daunting, but careful evaluation is key. Consider your budget, existing infrastructure, and specific goals before settling on a solution. SAP Ariba offers unparalleled control and integration, while Basware prioritizes user-friendliness and affordability. Tradeshift champions collaboration and network access, while Orbia excels in fast deployments and domestic scalability. eFactor specializes in early payment financing. The perfect SCF software is a personal odyssey – analyze your needs, explore the features, and choose the champion that empowers your unique supply chain journey.

Contact us today if you need help choosing the best supply chain finance software for your business!

FAQs

What is SCF in finance?

SCF is a financial strategy that optimizes cash flow by providing short-term credit to improve the liquidity of companies within a supply chain.

Who uses SCF?

SCF is utilized by businesses involved in a supply chain, including buyers and suppliers, to enhance working capital, manage cash flow, and strengthen financial relationships.

Why is supply chain finance important?

Supply chain finance is crucial as it facilitates smoother cash flow, reduces working capital constraints, and fosters collaboration between trading partners.

What is invoice financing?

Invoice financing is a form of short-term borrowing where a company uses its unpaid invoices as collateral to secure a cash advance.