Beneath the gleaming facade of e-commerce is a complex machinery. Orders dance between platforms, invoices pirouette through emails, and payments tap-dance across accounts. But what if this intricate performance could be simplified? That’s where Electronic Data Interchange (EDI) payments and ERP integration come in.

In this blog, we will unravel the connection between EDI and ERP. We will also talk about how their relationship is reshaping the very foundations of e-commerce. From simplifying operations to securing transactions, let’s look at EDI payments and ERP integration in online business.

EDI Payments

Imagine a world where purchase orders, invoices, and payments flow effortlessly between your e-commerce platform and trading partners. EDI payments make this a reality. EDI payments are the electronic exchange of payment-related information between trading partners using standardized data formats. It is a technology that enables the computer-to-computer exchange of business documents in a machine-readable format.

EDI payments specifically pertain to the electronic transmission of payment-related data, such as invoices, purchase orders, remittance advice, and other financial transactions. Businesses can automate the finances of e-commerce and simplify processes through it.

The Benefits of EDI Payments in E-commerce:

- Manual data entry is a time-consuming and error-prone process. EDI eliminates this need, slashing administrative costs and saving valuable time.

- EDI payments expedite the entire order-to-cash cycle. This leads to quicker settlements and improved cash flow.

- EDI eliminates manual data entry errors. This ensures accurate financial transactions and reduces the risk of disputes.

- Real-time data exchange through EDI gives businesses greater transparency into their financial operations.

EDI and ERP Integration

ERP systems act as the central nervous system of a business. It manages everything from inventory and production to accounting and customer relationships. Integrating EDI payments with your ERP system creates a unified platform for managing financial transactions. Integrating EDI with ERP ensures that data generated through electronic transactions flows into ERP.

Why ERP and EDI Payments Integration?

Here is why ERP and EDI payments integration is worth the hassle!

- Ditch the paperwork: EDI eliminates manual data entry for orders, invoices, and payments. This turns that paper piles into a streamlined digital flow.

- Speed things up: Orders zip to suppliers, payments zoom back, and everything happens in a blink. Say goodbye to slow transactions and frustrated customers!

- No more mix-ups: EDI’s standardized language cuts out errors, leaving trust and smooth sailing behind.

- Better decisions, faster: Real-time data flows into your ERP system. This gives you a clear picture of your business and the power to make informed decisions.

- Happy customers: Faster orders, fewer errors, and smooth payments? Your customers will be satisfied and happy.

Together, they create a symphony of efficiency that boosts your e-commerce performance.

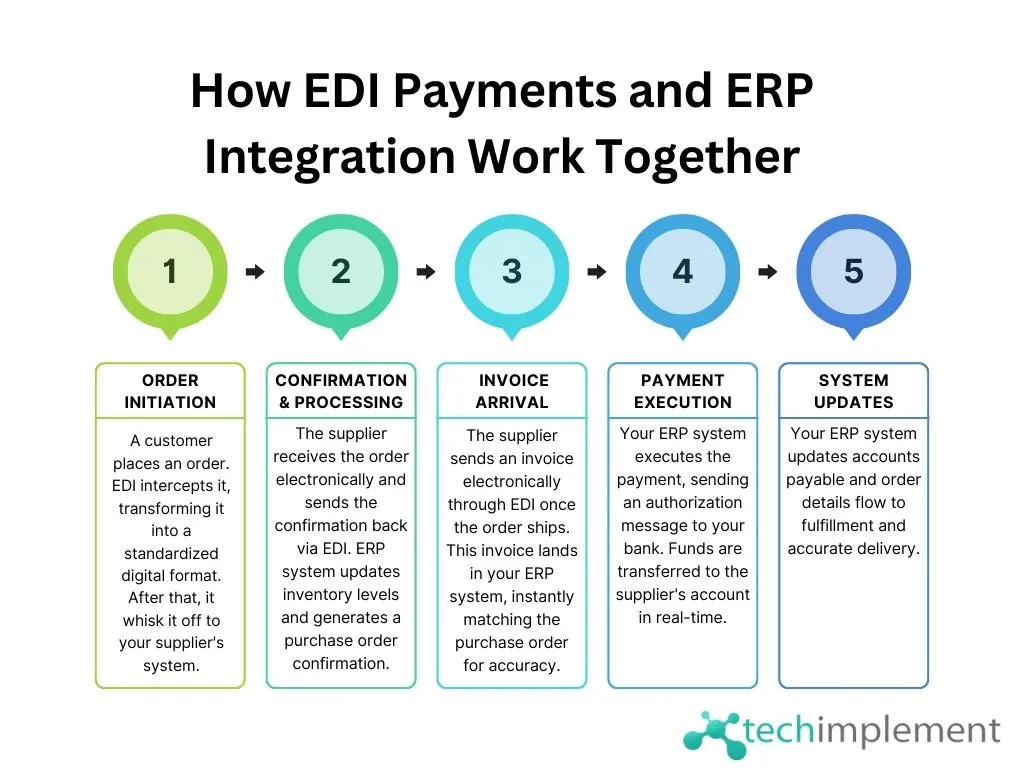

How EDI Payments and ERP Integration Work Together

Here is how they work together:

Benefits of EDI over API:

Integrating systems to simplify business processes is essential in today’s interconnected world. While APIs have become ubiquitous for data exchange, EDI offers unique advantages for specific transaction types, mainly e-commerce.

Here’s a closer look at the benefits of EDI over API in these scenarios:

1. Standardization and Compliance:

- EDI adheres to industry-specific standards (e.g., ANSI X12, EDIFACT). It ensures consistent formatting and interpretation of business documents across organizations and geographies. This eliminates manual data entry errors and facilitates compliance with regulatory requirements.

- APIs often need more standardized formats. This leads to potential compatibility issues between different systems and complicates compliance.

2. Large-Volume Data Handling:

- EDI excels in efficiently transmitting large, complex business documents like purchase orders, invoices, shipping notices, and inventory updates. It’s optimized for batch processing and handling high-volume transactions.

- APIs are often better suited for real-time or interactive data exchanges. However, they may face performance challenges when handling large data volumes.

3. Security:

- EDI typically relies on secure, private networks (VANs or AS2) for data transmission. It offers strong encryption and authentication measures. It has a long-established track record of security in sensitive B2B transactions.

- APIs often use the internet for communication. This increases vulnerability to cyberattacks if not adequately secured and monitored.

4. Cost-Effectiveness:

- EDI can reduce transaction costs significantly compared to manual processing or API-based integrations. It eliminates manual data entry, minimizes errors, and streamlines workflows. This leads to labor cost savings and improved efficiency.

- APIs can involve development and maintenance costs and potential fees for accessing external services.

5. Interoperability:

- EDI’s standardized structure enables seamless communication between diverse systems and trading partners, regardless of their internal software or hardware. It promotes a common language for business transactions.

- APIs often require custom integrations and mapping between different systems. This can become complex and time-consuming to maintain.

The Impact on the E-commerce Ecosystem

The combined power of EDI payments and ERP integration is revolutionizing e-commerce. This dynamic duo is creating a win-win situation for both businesses and consumers by simplifying operations, reducing costs, and improving customer satisfaction.

For businesses:

- Increased profitability through operational efficiency and cost savings.

- Improved competitiveness through faster order fulfillment and enhanced customer service.

- Scalability to accommodate growth without sacrificing efficiency.

For consumers:

- Faster and more convenient shopping experience.

- Improved accuracy and reliability of transactions.

- Greater confidence and trust in online retailers.

Conclusion:

In e-commerce, integrating EDI payments and ERP systems emerges as a game-changer. This enhances operational efficiency in securing transactions and envisioning the future. This symbiotic relationship is the key to navigating the complexities of modern online business. Remember, the impact of EDI payments and ERP integration extends far beyond just e-commerce. By embracing it, enterprises across all industries can unlock new operational excellence.

If you’re using an ERP system without EDI capabilities, it’s time for a change. To learn more about the ERP services we offer, contact us.

FAQs

What is EDI integration in ERP?

EDI integration in ERP refers to the seamless incorporation of EDI technology into ERP systems for standardized electronic communication of business documents and data.

Is EDI an ERP system?

No, EDI is not an ERP system. It is a technology that facilitates the electronic exchange of business documents,

Which payment system uses EDI?

EDI is commonly used in various payment systems, including business-to-business (B2B) transactions, supply chain management, and electronic invoicing.

What is the format of EDI payments?

The format of EDI payments follows standardized data formats, often conforming to EDI standards such as ANSI X12 or EDIFACT.