In the dynamic world of mortgage lending, where customer relationships and efficient processes are crucial, Mortgage CRM systems have emerged as a powerful tool for lenders and brokers. These systems provide data-driven insights and manage customer relationships. In this comprehensive guide, we will discuss Mortgage CRM systems, exploring what they are, why they matter, their key features, benefits, and how to choose the right one for your business.

What are Mortgage CRM Systems

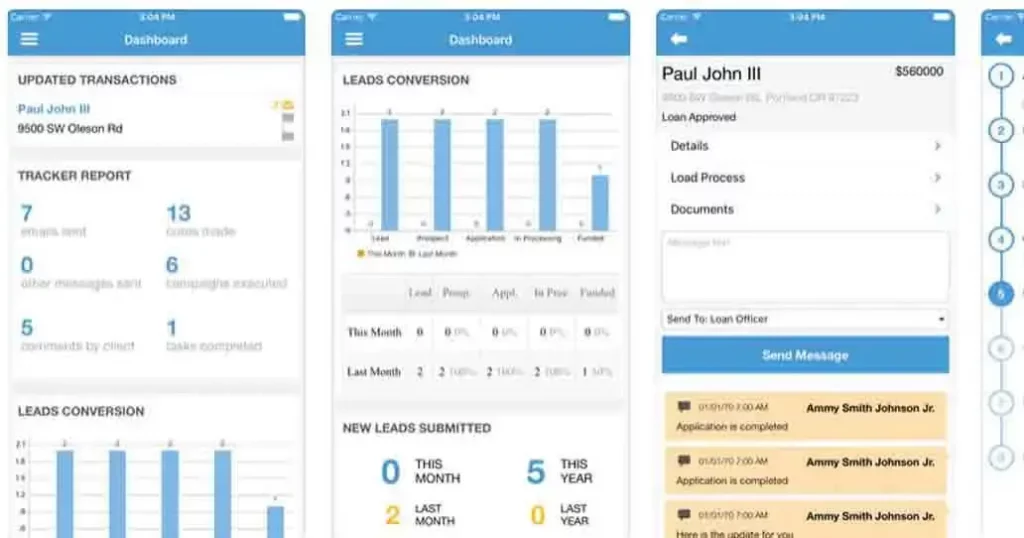

A Mortgage CRM system is a software solution designed specifically for the mortgage industry to manage customer interactions, automate processes, and optimize loan pipelines. It acts as a centralized hub that collects, organizes, and analyzes customer data, allowing lenders and brokers to make informed decisions and provide services according to their customer’s needs.

Why Mortgage CRM Systems Matter?

Efficiency Enhancement:

Mortgage CRM systems automate time-consuming tasks such as lead management, document collection, and follow-up communications. This frees up valuable time for loan officers to focus on building relationships and closing deals.

Improved Customer Experience:

By maintaining a comprehensive view of each borrower’s history and preferences, mortgage professionals can offer better advice and solutions, creating a more positive and satisfying experience.

Pipeline Transparency:

These systems provide real-time visibility into the loan pipeline, helping management monitor progress, identify bottlenecks, and administer resources effectively.

Compliance and Security:

Mortgage CRM systems often include features that help maintain regulatory submission and data security, a critical aspect of the mortgage industry.

Key Features of Mortgage CRM Systems

- Capture, track, and nurture leads, boosting conversion rates.

- Send personalized messages, updates, and reminders to borrowers and partners at various stages of the loan process.

- Store, organize, and manage essential documents securely within the system, reducing paperwork.

- Automate routine tasks like appointment scheduling and follow-ups, increasing productivity.

- Seamlessly integrate with other software like loan origination systems, ensuring data consistency.

- Generate insights from data to make informed decisions, forecast trends, and optimize processes.

- Provide borrowers with access to their loan status, documents, and communication history.

Benefits of Mortgage CRM Systems

Mortgage CRM software has many benefits ranging from high efficiency to real-time insights. Here are some of them:

Increased Efficiency:

Automating processes reduces manual work, minimizing errors and speeding up loan processing.

Enhanced Collaboration:

Team members can access and update borrower information in real-time, improving teamwork and communication.

Data-Driven Insights:

Analytics help in understanding customer behaviors, allowing for better-targeted marketing and service offerings.

Personalized Customer Interactions:

CRM systems enable tailored interactions based on borrower preferences and histories, fostering stronger relationships.

Scalability:

As your business grows, CRM systems can accommodate increased workloads and expanding client bases.

Choosing the Right Mortgage CRM System

Follow these steps while choosing the right mortgage CRM software:

- Assess your business requirements and pain points to understand what features are essential.

- Choose a system that can accommodate your growth without significant disruptions.

- A user-friendly interface ensures smoother adoption by your team.

- Ensure the CRM system can integrate with your existing software ecosystem.

- Look for systems that allow customization to match your workflow.

- Research vendors, read reviews, and consider their industry reputation.

Conclusion

Mortgage CRM systems have become a cornerstone of modern mortgage lending, offering tools to streamline operations, enhance customer experiences, and drive business growth. By understanding the features, benefits, and considerations when selecting a CRM system, lenders and brokers can take their mortgage businesses to the next level, fostering lasting relationships and optimizing processes in an ever-evolving industry.

Tech Implement offers customized CRM services, including Mortgage CRM, so contact us and book your appointment with our CRM consultants.