In financial services, converting leads into loyal clients is essential for success. But with rising customer expectations, many financial institutions struggle to keep up. That’s where a robust CRM system can be a game-changer.

A financial services CRM is more than just a contact database. It transcends mere contact storage, transforming into a weapon in your sales arsenal. It simplifies the journey from lead to loyal client. It automates tedious tasks, nurtures relationships, and drives sales.

This is not just another software fad. This revolution revolutionizes how you connect with your clients and convert their financial dreams into reality. So, buckle up as we dive deep into the five ways a CRM can propel your financial sales to new heights.

Financial Services CRM

Financial Services CRM is a specialized software designed to meet the needs of the financial industry. It is a tool for managing interactions with clients and simplifying financial processes. One of its primary functions is to enhance customer satisfaction by providing a centralized platform. This system enables financial service providers to understand their clients better. It also helps to track their preferences and deliver personalized services.

Financial Services CRM also plays a crucial role in compliance management. It ensures that financial institutions adhere to industry regulations and standards. Additionally, it facilitates communication and collaboration among team members. This enhances the efficiency of internal processes.

Features of Financial Services CRM

The following are the key features of Financial Services CRM

Why Do I Need a CRM for Financial Services?

Here is precisely why you need CRM for your financial services:

1. Boosting Sales and Conversions:

- Capture leads from various sources and qualify them efficiently.

- Craft personalized recommendations and communication based on individual needs and preferences.

- Free up your time from repetitive tasks like scheduling appointments and sending emails.

2. Enhancing Client Relationships and Retention:

- Gain a comprehensive understanding of each client’s portfolio, risk tolerance, and past interactions.

- Anticipate potential challenges and offer solutions based on data-driven insights.

- Break down communication silos between teams. This ensures everyone is on the same page and working towards client satisfaction.

3. Gaining Data-Driven Insights and Making Informed Decisions:

- Monitor campaign performance, sales pipelines, and client behaviour to identify areas for improvement.

- Use data to identify potential risks and opportunities.

- Target your marketing efforts to the right audience with personalized campaigns based on client data.

How to Boost Your Sales with Financial Services CRM

Here are five ways to boost your Sales with Financial Services CRM:

1. Automate Lead Generation and Qualification:

Gone are the days of cold calling and chasing down unqualified leads. With a CRM, you can automate lead capture from various sources like your website, social media, and even industry events. The system then qualifies leads based on pre-defined criteria. This saves your sales team valuable time and effort. With this, you can focus on nurturing high-potential leads instead of sifting through irrelevant contacts.

2. Personalize Client Interactions:

In today’s age, clients expect modified experiences. A CRM gives you a 360-degree view of each client. This includes their investment goals, risk tolerance, and past interactions. This valuable data allows you to personalize your communication and recommendations. Think birthday greetings, market updates based on their portfolio, and even proactive alerts for potential risks.

3. Automate Tasks and Improve Efficiency:

Financial services involve a lot of paperwork and manual processes. A CRM can automate repetitive tasks like sending follow-up emails, scheduling appointments, and generating reports. This frees your team to focus on more strategic activities. Automating these tasks can increase your team’s overall productivity and efficiency.

4. Enhance Client Collaboration and Communication:

A CRM is a central hub for all client communication, ensuring everyone in your team is on the same page. Internal notes, shared documents, and activity logs keep everyone informed and secure collaboration. This fosters a more transparent and efficient client experience, increasing satisfaction.

5. Gain Actionable Insights and Make Data-Driven Decisions:

CRM systems are data powerhouses. They collect and analyze valuable data on client behaviour and lead conversion rates. This information can be used to identify trends and make data-driven decisions to optimize your sales strategies. You can pinpoint which marketing channels generate the most qualified leads or which sales tactics close the most deals.

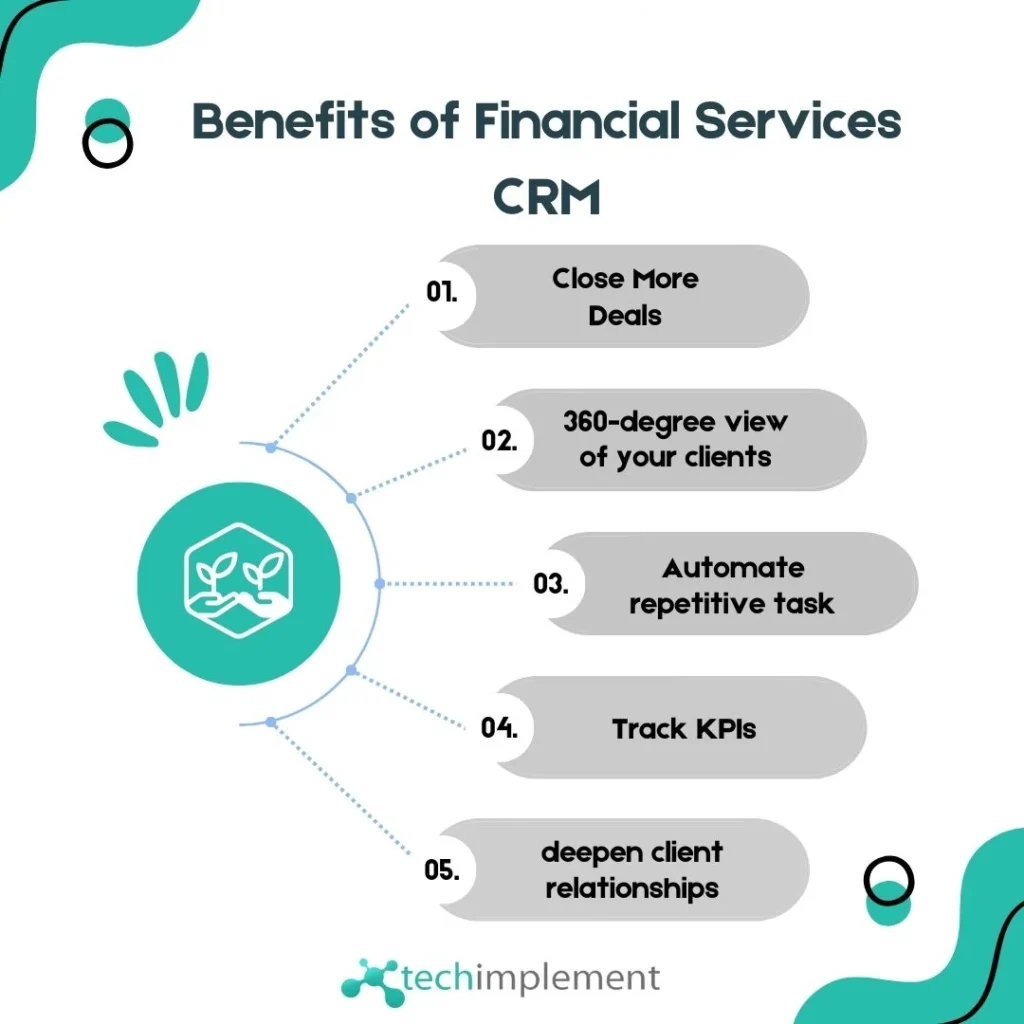

Benefits of Financial Services CRM

So, ditch the outdated sales tactics and embrace the power of CRM. Watch your financial sales rise like a tide, carrying you toward a future of thriving partnerships. Remember, in the competitive world of finance, having the right tools and strategies can make all the difference.

Are you ready to chart your course with CRM? Start exploring the endless possibilities today!

FAQs

What is CRM in financial services?

CRM in financial services refers to CRM software designed to meet the specific needs of the financial industry, enabling effective management of client interactions and processes.

Do financial advisors use CRM?

Yes, financial advisors commonly use CRM systems to manage client information and streamline communication.

Is CRM a financial system?

No, CRM is not a financial system. But it is used in financial services to manage customer interactions,

Why is CRM important in banking?

CRM is crucial in banking for its ability to centralize customer data, enhance communication, and improve customer service.